Alkimiya Beta User Guide

To access the Beta:

Username: pizza

Password: doughClick on Start Here

Leave your feedback on our testers Telegram group!

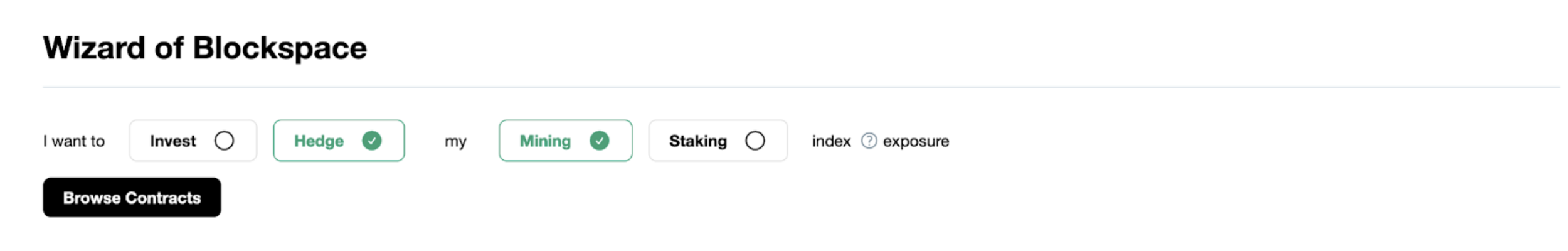

Alkimiya has four user archetypes:

Buy staking contracts if you want to invest in ETH staking yield.

Buy mining contracts if you want to invest in BTC mining exposure.

Sell staking contracts if you want to hedge staking exposure.

Sell mining hashpower contracts if you want to hedge mining exposure.

1. I want to invest in ETH staking yield

The return of the staking yield is based on the ETH staking index. It tracks the global average daily yield of ETH staking. The output is WETH per ETH’s yield per day, and refreshes once per day.

You can look at the Open Orders to see if there are any contracts that fit your requirements. The Estimated Daily Yield on the top left (0.000131) is the output of the ETH staking index on that day, and it provides an estimate of the dollar value of the reward.

The second column (Estimated Profit) is the difference between the unit price (Price per ETH’s Yield per Day) of the contract vs. the output of the index.

If you find a contract that you wish to buy, click on Buy Staking Yield.

This is a contract that expires on June 30th.

You do not have to fill the entire contract. You can fill in either the total amount of USDC, or the amount of Staked ETH that you want to purchase.

(Total Investment or Staked ETH will be automatically populated once you fill in your investment amount.)

Click on Approve USDC spend.

If you didn’t see a contract you want to buy, you can place a Buy Order for sellers to fill.

When placing a Buy Order, input the following parameters:

the Order Size, which is the total amount of stablecoins you want to spend to purchase a contract,

the contract Finish Date, and

the Price per Staked ETH per Day. The Price per Staked ETH per Day is the “unit price” of the contract. When compared against the Index output, it reflects the relative richness or cheapness of the contract.

After filling in the details, click Approve USDC spend. Wait for the transaction to go through, and then Create Order.

If your order is filled by a seller it will show up in the Portfolio under Bought Staking Yield on the side bar.

2. I want to invest in BTC mining return

The return of the hashpower is based on the BTC mining index. It tracks the global average daily yield of PH/s. The output is WBTC per PH/s per day (hashprice), and refreshes once per day.

First, look at the Open Orders to see if there are any contracts that fit your requirements. The Estimated Daily Yield on the top left (0.002526) is the output of the BTC mining index for that day, and it provides an estimate of the dollar value of the reward.

The second column (Estimated Profit) is the difference between the unit price (Price per PH/s per Day) of the contract vs. the output of the index.

If you find a contract that you wish to buy, click on Buy Hashpower.

This is a contract that expires on June 30th.

You do not have to fill the entire contract. You can fill in either the total amount of USDC, or the amount of hashpower that you want to purchase.

(The other value will be automatically populated once you fill in the first value.)

Click on Approve USDC spend.

If you didn’t see a contract you want to buy, you can place a Buy Order and wait for sellers to fill.

When placing a Buy Order, input the following parameters:

the Order Size, which is the total amount of stablecoins you want to spend to purchase a contract,

the contract Finish Date and

the Price per PH/s per Day. The Price per PH/s per Day is the “unit price” of the contract. When compared against the Index output, it reflects the relative richness or cheapness of the contract.

After filling in the details, click Approve USDC spend. Wait for the transaction to go through, and then Create Order.

If your order is filled by a seller it will show up in your Portfolio under Bought Hashpower on the side bar.